Industry Assets – October 2023

Before the advent of asset-based lending software, most lenders relied on Excel spreadsheets to manage and monitor the collateral supporting their Borrowing Bases. It was considered the most efficient and versatile method back then, but came with its fair share of shortcomings. Staff couldn’t collaborate simultaneously on the same document, version control was challenging, and the calculations were susceptible to error due to inputting data in multiple complex spreadsheets.

Beyond the challenges of using Excel, calculating client availability presented its own difficulties. Lenders had to develop methods to digest various data formats and manage different risk profiles. Ideally, if all clients standardized on a single Borrowing Base format, it would simplify lenders’ lives. However, the reality is far from that ideal, with clients varying in size, structure, and risk level.

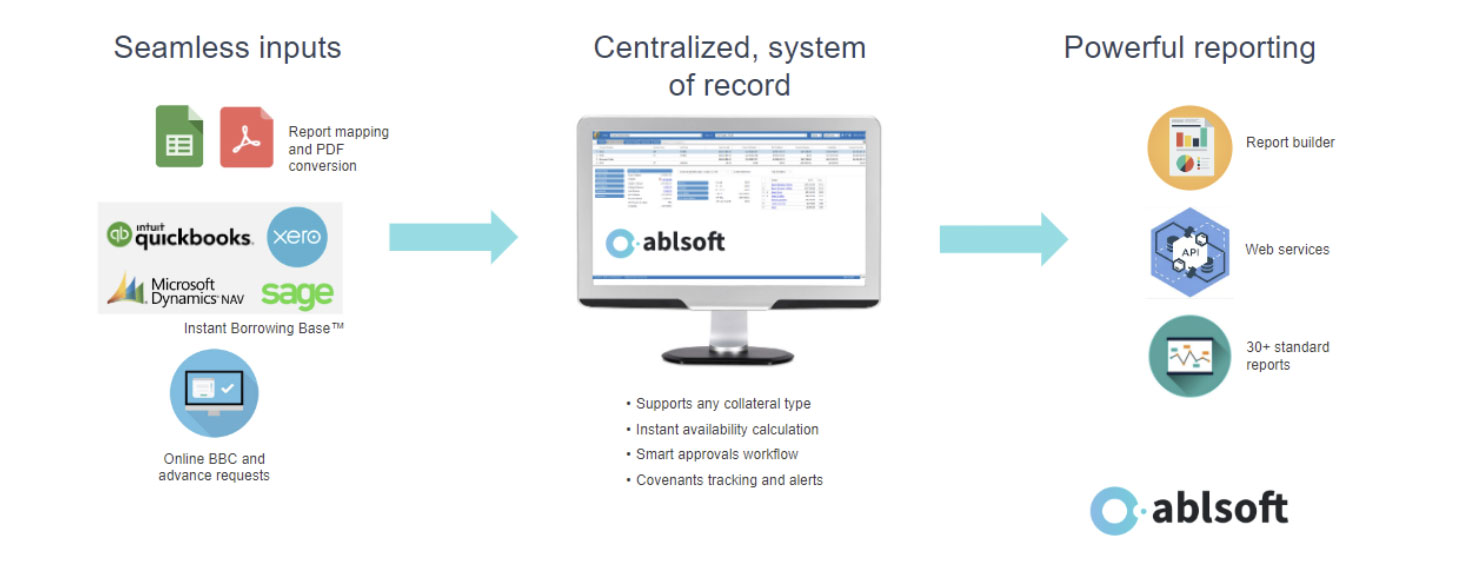

This is precisely where software platforms like ABLSoft shine and alleviate the pain. Our software can automate the ingestion of complex data formats like Excel, CSV, and PDF, commonly used for agings and supporting documents, all required to calculate the Borrowing Base. Software can also create greater efficiency with streamlined, automated workflows tailored to the specific needs of different client risk profiles.

For instance:

For instance:

- For lower-risk, upmarket loans, the workflow may involve a simple review and reconciliation of what the borrower submits versus what the lender calculates through the system.

- Higher-risk clients require a different approach, where the lender determines the Borrowing Base based on supporting documents rather than relying on the client’s calculation.

- In the most precarious situations, lenders may closely scrutinize invoices by individually comparing them to actual payments received to calculate the Borrowing Base.

- Conversely, there are situations where the convenience of importing all relevant data directly from accounting systems makes sense, especially for small and medium-sized businesses.

All these various workflows for processing the Borrowing Base are possible, and lenders should carefully consider which method aligns with their client risk levels.

What sets ABLSoft system apart is its ability to offer all these methods within a unified platform, allowing you to effectively support various risk profiles in one seamless system. That way, you can focus on growing your business rather than grappling with multiple software tools. Isn’t that a welcome relief?