Unlock Productivity

Don’t let legacy processes hold you back. Harness ABLSoft to automate BBC Processing, simplify the borrower experience and track loan performance – all in one secure platform.

Effortless Borrowing Base

Save time and automate your BBC intake process. Standardize and map data from Excel, PDFs, online BBC entry, even directly from borrowers’ accounting systems.

Intelligent Processing

Onboard any deal (AR, inventory, term) and customize as needed (sublimits, ineligibles, lockbox). Instantly calculate availability and streamline advance approvals.

Seamless Insights

Get immediate visibility with real-time dashboards and 30+ standard reports. Design your own reports in minutes to track borrower performance and compliance.

We speak your language

What Clients Are Saying

“ABLSoft’s platform makes our workflow smoother. We are constantly balancing and re-balancing; ABLSoft pushes our reports between teams and we can complete our processes within an hour!”

“It is easy to navigate and to monitor customer daily activity through the real-time data and reports in the system.”

“Our lending requires a high degree of complexity. ABLSoft has been diligent and resourceful at solving our unique challenges.”

“Your team is outstanding, everyone has been so helpful. We really appreciate the care and attention given to us. Thank you!”

Intelligent Automation

Born on the cloud, ABLSoft’s platform brings together unparalleled flexibility, intuitive automation, and intelligent decision-making within a modern, user-friendly enterprise solution.

Flexible & Comprehensive

No matter how you monitor your portfolio, our platform provides a rich feature set of no code configurations, an extensive and modular feature suite that supports all flavors of ABL, Factoring Light, Financial covenants and a Collateral Engine for tailored solutions.

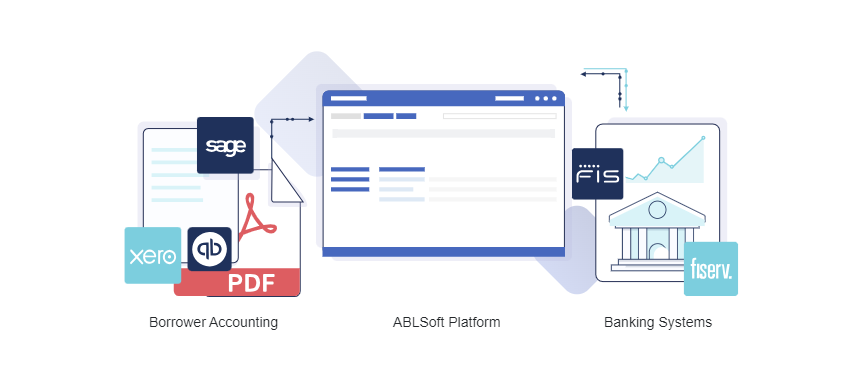

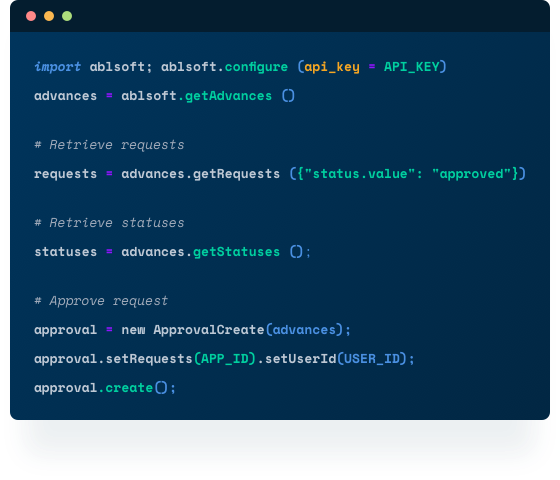

Powerful Integrations

Connect and simplify with powerful APIs. ABLSoft automates data transmission end-to-end. From borrower accounting to core banking, we enable an effortless information flow. No matter the systems, we’ll find the best solution.

Smart Decisioning

Real-time alerts and email reminders ensure tracking of compliance requirements. Utilize flexible reporting options to analyze ineligibles concentrations, agings, dilution, trends, portfolio and more.

Futureproof Your Business

Performance, scalability, security. Scale your business with our enterprise platform. From borrower accounting to core banking integrations using real-time APIs, we enable an effortless information flow. Advanced security and SOC 2 Type II compliance are our top priorities.

Partners & Integrations